Our Health Insurance is Trying to Steal from Us

My headline makes a bold a very blunt claim. Now, I’ll be honest that I don’t know if “stealing” is the right word per se, perhaps “cheating” would be a better term but basic terms aside it sure feels like we are being taken advantage of. We pay an arm and a leg for our private health insurance through Anthem Blue Cross Blue Shield. High monthly premiums, mixed with good size deductibles and a large out of pocket family max. We have to pay a lot of money out before our insurance even begins to cover anything other than basic checkups. I’ve looked at many alternatives but beyond me going back into the work force with a large company just to get a lower insurance payment, our options are limited. We have made our peace with the fact that insurance comes with a hefty bill and have done our best to budget accordingly. The one big aspect that I have not made peace with is the way that our insurance continuously tries to weasel their way out of paying for the services that we are entitled to in our plan, which they have constantly done for two years and they are currently going on a third. So, in case your insurance company is like mine (Yes, I’m calling out on how bad you SUCK Anthem), I am going to give you some tips and tricks to making sure your insurance isn’t screwing you out of money or services that you are entitled to.

- Online Portals

Nowadays most private insurance companies offer options of online portals or apps to use that can be really handy. Get familiar with this portal. It will be your go to in order to confirm current status of any claims, check and make sure doctors or hospitals are in network, and to keep track of your status with deductibles and out of pocket maximums.

- Read Your Medical Certificate Booklet (Explanation of Coverage)

No, I’m not talking about that simple one-page spreadsheet on basics of your coverage. I’m talking about the LONG contract plan that your insurance company is required to provide you that outlines everything that you are entitled to. I know your thinking, who has time for that? But I promise you that if you don’t know the ins and outs of your plan, there is a good chance you could be losing money or services that are entitled to you. If you have an online portal or a workplace HR there is a good chance you can find a digital copy of your plan there. (Pro-Tip for speed: When the digital document is open (CTRL and F) keys hit together will pop up a digital search tool where you can search the document for words such as autism).

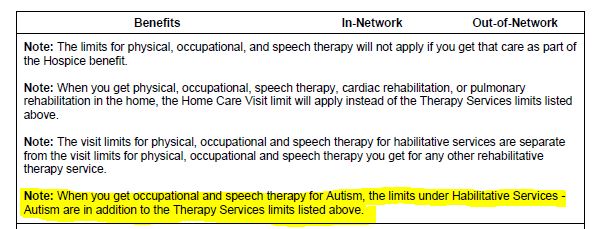

- Autism Diagnosis May Qualify a Person for Additional Services

This is the big one every year that we fight with our insurance on. I don’t know how many other plans are like this, but for our current plan, a child can qualify for 20 speech and 20 occupational therapy visits. If your child has a diagnosis of autism however, they can qualify for an additional 20 in both. Kind of a fine print thing that I feel like they may not like to tell you, but it is there! We currently aim for a private speech and OT visit each week for Damion, knowing that we will have to cancel here and there as to not go over the 40. Every year so far when we reach the 21-visit mark, they start denying the claim stating we are over our visit maximum, and then the fight begins…

- Write Down All Communications

Even though it always tells you calls are recorded for quality assurance when you call in, no one will ever seem to be able to pull up your last call. There is never a way to just email people when you have issues, because that would be too easy. Because of this, I keep a record of when I called, who I talked to, and what they told me. There is a good chance if you talk to two different people, you will get very different answers to the same question or procedure. The entry people that you get when you call into member services are generally not the people that have the authority to make any real changes, so getting something solved in one quick call is unlikely. Whether you are talking to someone higher up in the company or have to eventually utilize a third party to help resolve your issue, having those notes from previous interactions can come in very handy.

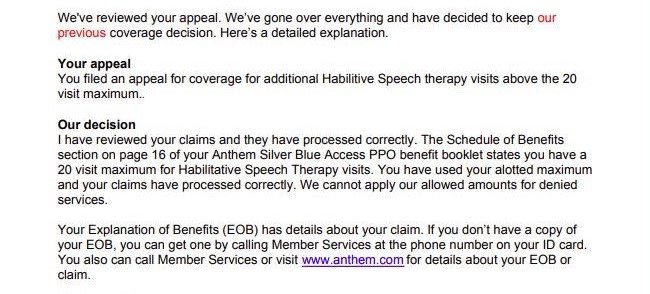

- Sometimes You Have to Get a Third Party Involved

In that plan booklet I discussed before, there is a section on what to do if you appeal a claim, and it is still denied. For my plan if this happens and I disagree with the decision, I have to submit a claim to the Ohio Department of Insurance for review. Having your notes, knowing your plan, and being very organized will be important in this. I have had to do this twice already, and it’s looking like this year may be year number 3. Every year that I have done this, Ohio Department of Insurance has rightfully ruled in my favor and our insurance company is forced to pay for all those claims they had denied.

I wish it is was simpler. Every year I file a claim with the Ohio Department of Insurance I am issued a letter stating that the issue has been looked into and it is being corrected. So far, every year I am still just as disappointed as the year before. I’d love to say that the problem is an honest mistake, but everything on the company’s end should be pretty straight forward. If I can pull up my plan and see what is covered, they should be able to do the same at least on a second level review. I’ve come to the conclusion that the people at our insurance company are either lazy, incompetent, or are just plain trying to swindle us.

On rare occasions you may be lucky enough to connect with someone who works for member services that is helpful, but that is a very rare occurrence. I’ve been told some ridiculous claims along the way as they try to get out of providing what is written so clearly in our contract terms. I know my plan well enough at this point that I just tell them they are wrong and to correct the issue. It is extremely frustrating as the fights can be time consuming, and a lot of work just to get the payments back for services that I was supposed to have covered in the first place. If it was a small amount of money, I may just throw in the towel and let the insurance company win without a fight. But I want my son to have all the services he needs and an extra 20 services in private speech and OT each year can rack up quite a chunk of change. I can guarantee there are people out there with children who have autism that do not have the time or enough knowledge of their plan and are scammed out of money or covered services. The idea of this is infuriating to me, hence why I am writing this week’s blog in hopes to help those who may not know. Needless to say, the fight can be long and hard, but if you don’t fight, you may not get what you are paying for.